Introduction: As restaurant owners navigate the challenges of operating in a competitive industry, maximizing cash flow becomes paramount for sustainable growth and success. Fortunately, there are several government programs designed to help businesses alleviate financial burdens and boost profitability. In this article, we’ll explore how restaurant owners can leverage Work Opportunity Tax Credits (WOTC), Empowerment Zones, FICA Tip Credits, and Cost Segregation to improve cash flow by more than 100% in the first year.

- Work Opportunity Tax Credits (WOTC): WOTC is a federal tax credit program that incentivizes businesses to hire individuals from targeted groups facing barriers to employment. Restaurant owners can claim tax credits ranging from $1,200 to $9,600 per eligible employee, depending on the target group. By participating in WOTC, restaurants can significantly reduce their tax liabilities while supporting workforce diversity and inclusion.

- Empowerment Zones: Empowerment Zones are designated geographic areas with economic challenges where businesses can qualify for tax incentives, including wage credits and accelerated depreciation. Restaurant owners operating within these zones can benefit from tax breaks on qualified investments, thereby improving cash flow and stimulating economic growth in their communities.

- FICA Tip Credits: FICA Tip Credits allow restaurants to claim a tax credit on the employer portion of FICA taxes paid on tips allocated to employees. By accurately tracking and reporting tip income, restaurant owners can reduce their payroll tax obligations and increase cash flow. This credit provides a valuable incentive for restaurants to invest in employee training and retention initiatives.

- Cost Segregation: Cost Segregation is a tax planning strategy that involves reclassifying certain assets in a commercial property to accelerate depreciation deductions. For restaurant owners, this means identifying components of their building or renovations that can be depreciated over shorter recovery periods. By leveraging Cost Segregation, restaurants can generate immediate tax savings and improve cash flow in the short term.

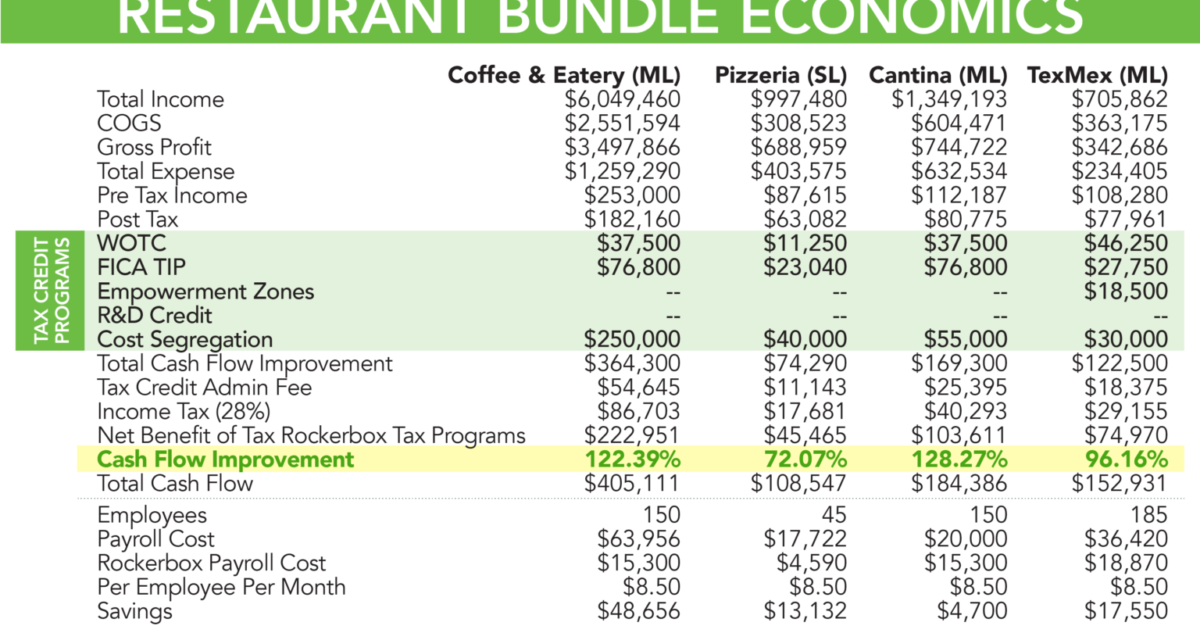

The Restaurant Bundle by Rockerbox: Rockerbox has curated a comprehensive solution, known as the Restaurant Bundle, that combines WOTC, Empowerment Zones, FICA Tip Credits, and Cost Segregation into a single offering. This bundled approach streamlines the process for restaurant owners to access and maximize these tax credit programs, thereby enhancing their cash flow and overall financial performance.

Conclusion: Incorporating tax credit programs such as WOTC, Empowerment Zones, FICA Tip Credits, and Cost Segregation can have a transformative impact on a restaurant’s cash flow and bottom line. By strategically leveraging these incentives, restaurant owners can not only reduce their tax liabilities but also reinvest savings into their business for continued growth and success. With the Restaurant Bundle provided by Rockerbox, restaurant owners have a simplified and efficient solution to unlock the full potential of these valuable tax credit programs.