The Rockerbox Restaurant Bundle is designed with restaurant owners in mind. To help restaurants recover from the forced pandemic restrictions and increased costs due to recent inflation, our Restaurant Bundle stabilizes your cash flow with one provider.

Through the use of our simple new hire onboarding and payroll systems, we’re able to execute various tax credit and cost reduction programs to improve cash flow up to 100%. Once setup and used by your restaurant, the cash flow acceleration and cost reduction programs are automatically executed behind the scenes, leaving literally nothing extra for you or your managers to do.

Unlock Your Restaurant’s Cash Flow

The Restaurant Bundle

What’s Included

With the Rockerbox Restaurant Bundle, you have the flexibility to choose the individual solutions that best suit your restaurant’s needs. Whether you’re looking to maximize cash flow, unlock valuable tax credits, or streamline payroll operations, our bundle has you covered.

Integrates with Leading POS Systems

It’s Easy to Start!

- Sign Restaurant Bundle Engagement Letter

- Sign POA for Tax Credit Administration

- Attend Kickoff Call

- Go Live!

All Types Of Restaurants

No matter what type of restaurant you have our Restaurant Bundle will assist with finding valuable tax credits, decrease payroll costs, and improve cash flow.

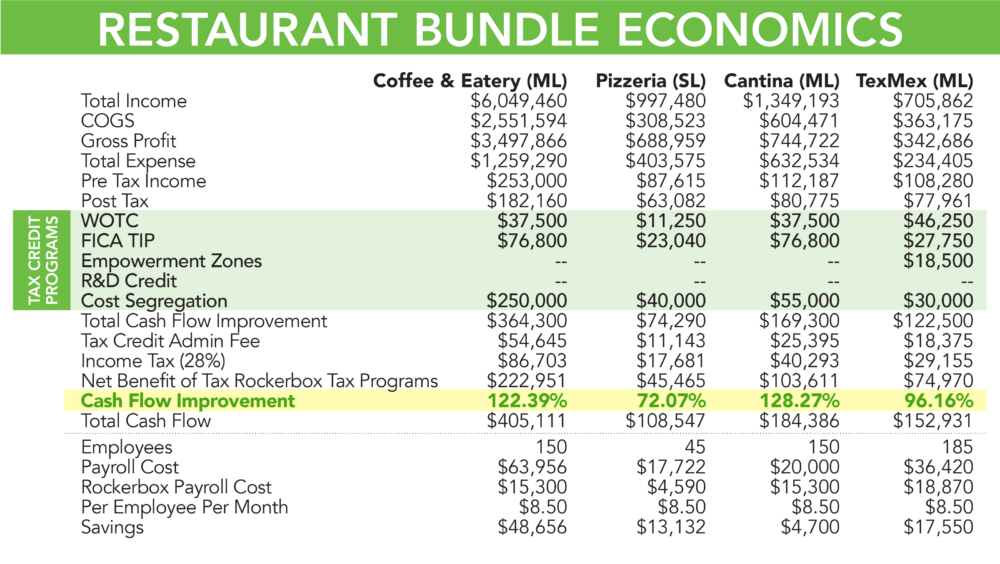

Client Savings

Real-world Case Studies

WOTC Screening

The Work Opportunity Tax Credit (WOTC) is a federal program designed to help disadvantaged workers find jobs. Restaurants can receive tax credits when they hire individuals from specific groups that often struggle with employment. The amount of the credit depends on the wages earned by the new hire.

Benefits of WOTC Screening

- 20% of new hires are potentially eligible

- Receive up to $2,150 per eligible employee on average

- Increase cash flow up to 40% with WOTC alone

- The amount of credit available is limitless

R&D Tax Credit

The Research & Development (R&D) Tax Credit can be a valuable incentive for businesses engaged in qualifying research activities. While it might not be obvious, restaurants can qualify for the R&D tax credit, depending on the nature of their activities.

R&D Tax Credit Examples for Restaurants

- Developing innovative food recipes or beverage formulas that require experimental techniques.

- Implementing new food preservation techniques or kitchen technologies.

- Experimenting with new food production or cooking processes to improve efficiency, sustainability, or quality.

- Developing gluten-free or allergen-free versions of traditional dishes, which require significant testing and experimentation.

Routine activities, such as standard meal preparation or regular kitchen operations, do not qualify.

Cost Segregation Evaluation

Restaurant owners should consider an evaluation if they own or lease their building. Whether you are building, remodeling, expanding, or purchasing a facility, a cost segregation study can help increase your cash flow. Many property owners do not take advantage of these provisions and end up paying federal and state income taxes sooner than they need to.

Benefits

- Reduced tax liability

- Improved cash flow

- Enhanced financial performance

- Accelerate depreciation

- 30% average reclassification

Common Assets

- Building structures: drive thru windows, canopies, awnings, etc.

- Interior improvements: flooring, etc.

- Kitchen equipment: cooking, refrigeration, food prep, dishwasher, etc

- HVAC systems

- Plumbing and electrical: accessory lighting, parking lot lighting

- Decor and signage

- Exterior improvements: landscaping, patio dumpster enclosures, sidewalks, etc.

Here’s how shorter depreciation periods lead to cash flow improvement:

Standard depreciation: 39 year schedule

$50,000 interior improvement would normally result in a year 1 depreciation of $1,282.

$50,000 in equipment would once again result in a year 1 depreciation of $1,282.

With Cost Segregation: 5, 7, and 15 year schedules

The same $50,000 interior improvement depreciated using our comprehensive cost segregation study leads to a year 1 depreciation of $6,666.

With Rockerbox that $50,000 of equipment would result in a depreciation of $38,000 and even sometimes the full $50,000 in year 1!

Payroll (optional)

- Full-service automated payroll

- All federal, state and local taxes automatically calculated and paid

- Free electronic W2s

- Automated garnishments

- Insta-Pay and branded pay-cards

- Time clock included

- PTO management

- Employee self-service portal

- Payroll funding (up to 90-days)

- Same day ACH

- Many additional features you expect to have

Restaurant Bundle can improve your restaurant’s cash flow up to 100%

No Heavy Lifting.

Call 469-461-1912 to get started or to learn more.