AxisCare Clients: Unlock the full potential of your WOTC program!

So, you are an AxisCare client working with another WOTC provider? Did you know that AxisCare and Rockerbox have an exclusive partnership and integration?

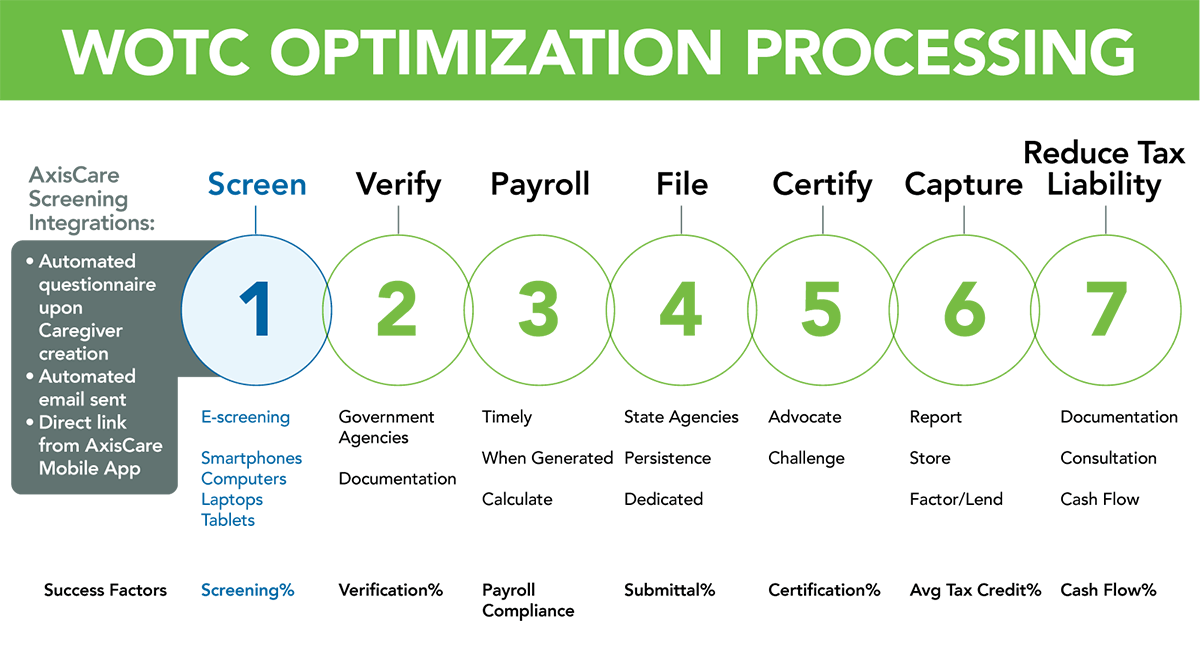

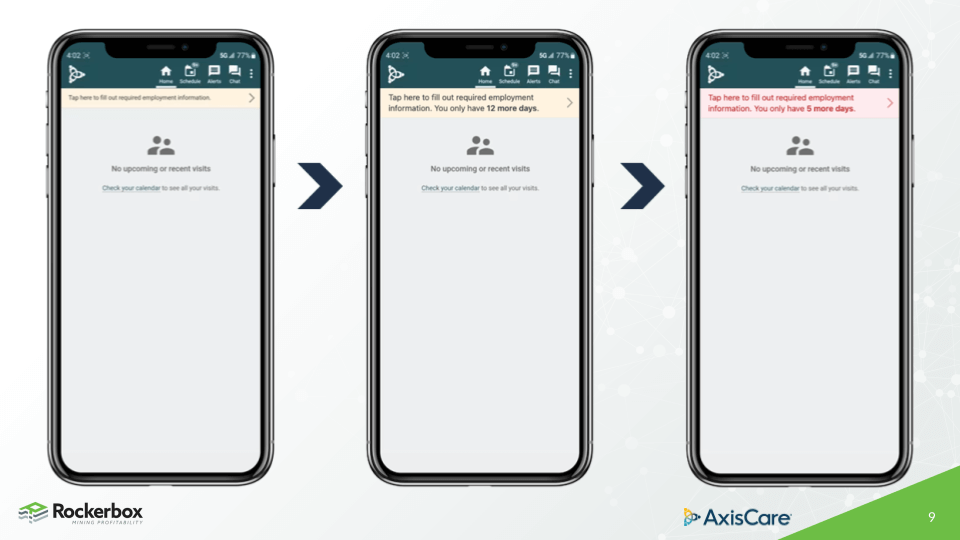

This integration means that your existing WOTC program can be fully optimized by leveraging Rockerbox’s powerful WOTC optimization platform within AxisCare’s agency management system.

To help you evaluate the benefits of our seamless integration, we offer a no-cost WOTC Optimization Audit. This audit allows your agency to pinpoint exactly where your current WOTC program may be falling short and how Rockerbox’s advanced integration and tools can enhance your results—at absolutely no obligation.

The audit will provide the following:

1) A thorough analysis of your current WOTC program (reports, processes, and outcomes);

2) Expert insights from Rockerbox’s dedicated WOTC specialists;

3) Identification of missed opportunities and areas for improvement;

4) Actionable strategies to increase your WOTC credits.

On average, Rockerbox improves existing WOTC results between 3-5 times. With our exclusive AxisCare integration, your agency can streamline workflows, reduce administrative burden, and significantly increase WOTC tax credits.

Take advantage of this free, no-obligation WOTC Optimization Audit today and see how AxisCare + Rockerbox can drive measurable financial benefits for your agency.

WOTC Audit Benefits

The Rockerbox Advantage

Rockerbox Integration Includes

Payroll Data Automation

Payroll batch report to the rescue!

Once the payroll batch report is created within AxisCare, the report, and its data, are automatically routed to Rockerbox for processing. Contact us today for a walk-thru of how the process works.

What is WOTC?

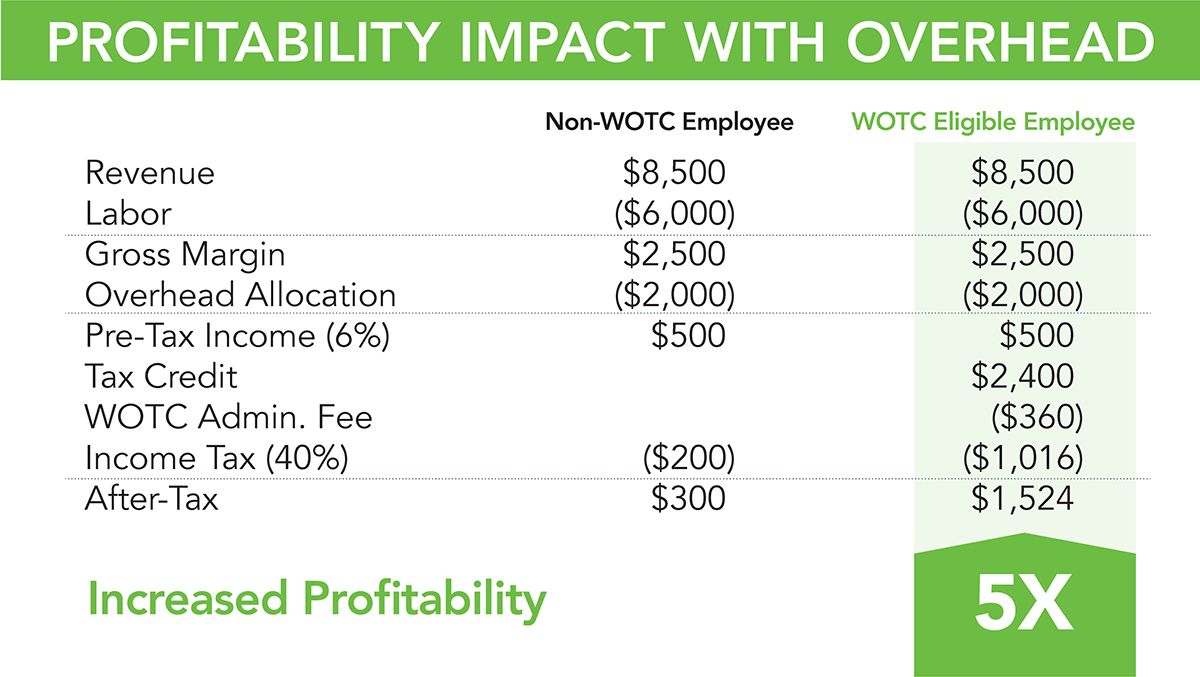

The Work Opportunity Tax Credit (WOTC) program incentivizes businesses to hire qualified individuals from targeted groups facing employment challenges. In the healthcare industry, this can be a powerful tool for improving cash flow and making a positive social impact.

WOTC Benefits

WOTC Made Easy

Rockerbox streamlines the complex WOTC process within AxisCare, ensuring that home health agencies maximize their tax credits with minimal effort. Our team of experts handles all the electronic filings and ensures compliance, allowing you to focus on what matters most – running your business.

Did You Know?

20%

Of new caregivers potentially eligible

$1,150

Per eligible new caregiver on average

40%

Increase in your business cash flow

No Limit

To the amount of credit available

Fanatical Support

We’re here when you need us.

Fram Abarrientos

Client Success Manager

[email protected]

972-246-8966

Karen Bianchi

Client Success Manager

[email protected]

586-864-3956

Macky Macapagal

Client Success Manager

[email protected]

972-325-2458