Made for golf course owners, the Rockerbox Golf Course Bundle is here to help. With recent inflation driving up costs and the pandemic’s impact still lingering, our bundle simplifies things by keeping your cash flow steady with a single provider for your needs.

Our user-friendly onboarding and payroll systems make it easy to implement tax credits and cost-cutting programs that can potentially double your cash flow (up to 100% improvement). Once set up, these programs run automatically in the background, saving you and your managers valuable time and effort.

Unlock Your Golf Course’s Cash Flow

The Golf Course Bundle

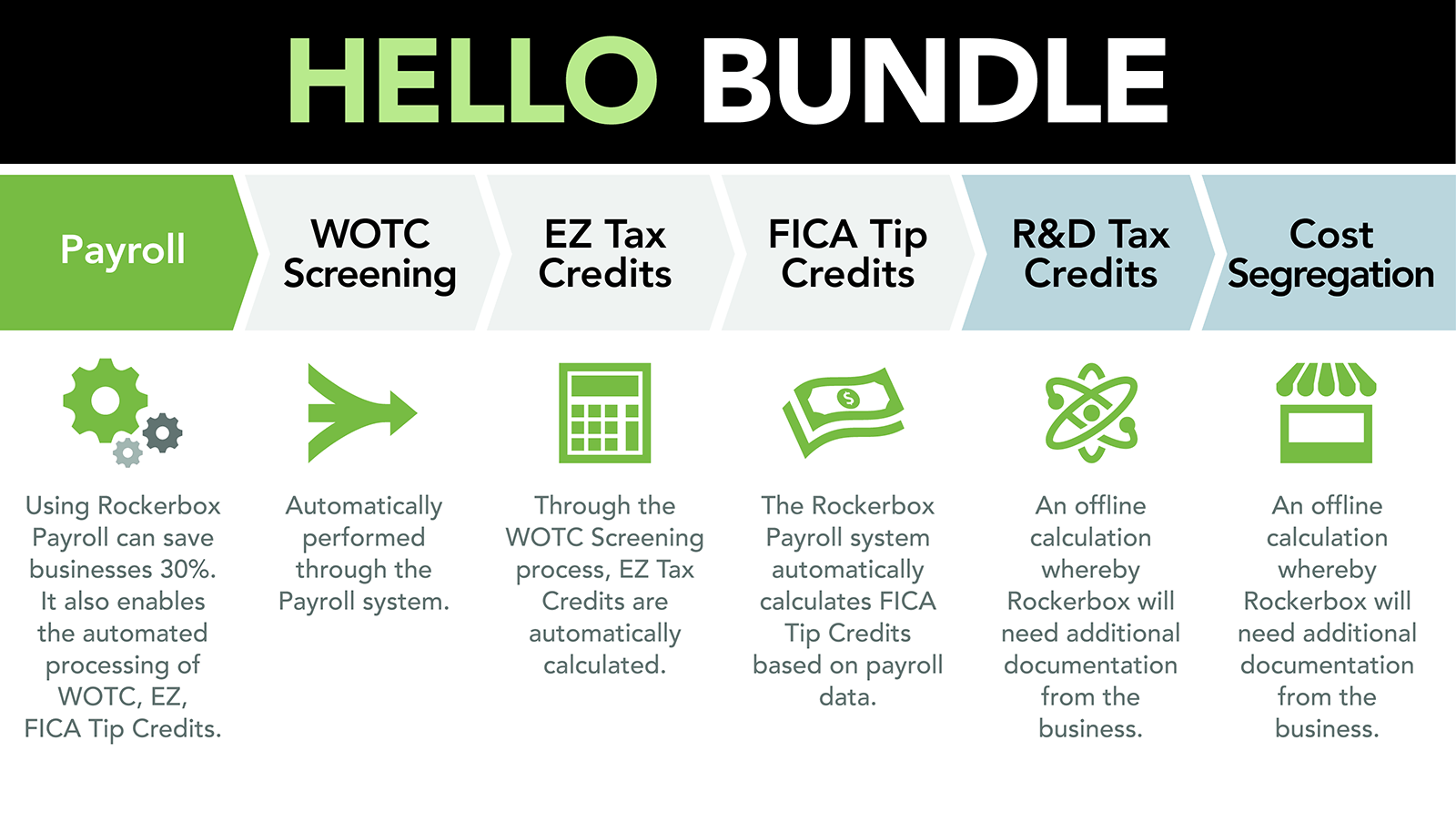

What’s Included

The Rockerbox Golf Course Bundle offers a flexible approach. Need to boost cash flow, claim tax credits, or simplify payroll? Our bundle can handle it all, allowing you to pick the features that best fit your course’s specific needs.

Converting is Easy!

- Sign Golf Course Bundle engagement letter

- Sign POA for tax credit administration

- Provide payroll history

- Attend kickoff call

- Go live!

From your clubhouse to your fairway and everything in between, our Golf Course Bundle will assist with finding valuable tax credits, decrease payroll costs, and improve cash flow.

Discover your potential savings!

Request a discovery call today.

WOTC Screening

The Work Opportunity Tax Credit is a federal tax credit that helps drive employment by putting disadvantaged workers back to work. WOTC benefits are available to golf courses who hire individuals from one of nine targeted groups who frequently face barriers to employment. The amount of WOTC credit an employer receives is based on the amount eligible employees earn.

Benefits of WOTC Screening

R&D Tax Credit

The Research & Development (R&D) Tax Credit can be a valuable incentive for businesses engaged in qualifying research activities. While it might not be obvious, golf courses can qualify for the R&D tax credit, depending on the nature of their activities.

R&D Tax Credit Examples for Golf Courses

Routine activities, such as standard meal preparation or regular kitchen operations, do not qualify.

Cost Segregation Evaluation

Knowing the amount of equipment, improvements, and structures a golf course has, owners should consider an Cost Segregation Evaluation. Whether you are building, remodeling, or expanding, a cost segregation study can help increase your cash flow. Many owners do not take advantage of these provisions and end up paying federal and state income taxes sooner than they need to.

Benefits

Common Assets

Shorter depreciation periods lead to cash flow improvement

Standard depreciation: 39 year schedule

$50,000 interior improvement would normally result in a year 1 depreciation of $1,282.

$50,000 in equipment would once again result in a year 1 depreciation of $1,282.

With Cost Segregation: 5, 7, and 15 year schedules

The same $50,000 interior improvement depreciated using our comprehensive cost segregation study leads to a year 1 depreciation of $6,666.

$50,000 of equipment depreciated over 5 years results in a year 1 depreciation of $20,000.

Payroll (optional)

- Full-service automated payroll

- All federal, state and local taxes automatically calculated and paid

- Free electronic W2s

- Automated garnishments

- Insta-Pay and branded pay-cards

- Time clock included

- PTO management

- Employee self-service portal

- Payroll funding (up to 90-days)

- Same day ACH

- Many additional features you expect to have

The Golf Course Bundle can improve your golf course’s cash flow up to 100%

No Heavy Lifting.

Call 469-461-1912 to get started or to learn more.