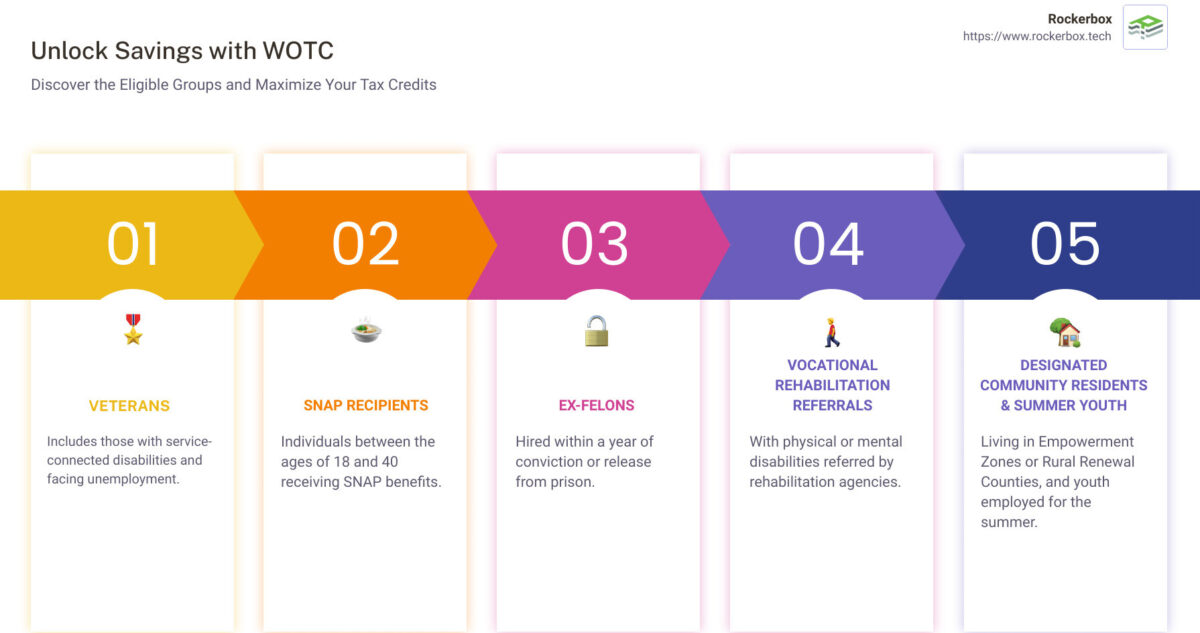

Quick Answer: Who qualifies for the Work Opportunity Tax Credit (WOTC)?

1. Veterans, including those with service-connected disabilities, facing unemployment.

2. SNAP (Food Stamp) recipients between the ages of 18 and 40.

3. Ex-felons hired within a year of conviction or release from prison.

4. Vocational Rehabilitation referrals with physical or mental disabilities.

5. Designated Community Residents living in Empowerment Zones or Rural Renewal Counties, and Summer Youth employees.

The Work Opportunity Tax Credit (WOTC) is more than just a tax incentive—it’s a helping hand extended by businesses to those in the workforce who have had to climb higher walls to find employment. For small business owners navigating the cascades of financial management, understanding and utilizing WOTC can be a beacon of hope, illuminating paths towards both corporate responsibility and enhanced cash flow.

WOTC rewards businesses that choose to hire individuals from groups facing significant barriers to employment. This includes veterans struggling to adjust to civilian life, individuals dependent on SNAP benefits, ex-felons aiming for reintegration, and more. By offering a tax credit for hiring from these communities, WOTC not only fosters diversity and inclusion in the workplace but also supports employers in their pursuit of passionate, dedicated employees.

Beyond altruism, there’s a practical benefit: bolstering your bottom line. When every penny counts—especially for the cash-strapped entrepreneur—WOTC represents a straightforward opportunity to reduce tax liabilities, potentially by thousands of dollars.

Veterans

When we talk about who qualifies for the work opportunity tax credit, veterans are often at the forefront. Their service to our country makes them not just heroes but also valuable assets in the workforce. Let’s break down how veterans, in particular, can unlock the benefits of WOTC for potential employers.

SNAP Benefits

Many veterans face economic challenges upon returning to civilian life. Those receiving SNAP (Supplemental Nutrition Assistance Program) benefits are eligible under WOTC, offering a unique opportunity for employers to support and gain from hiring veterans in need.

Service-connected Disability

Veterans with service-connected disabilities bring resilience, adaptability, and diverse perspectives to the workplace. Hiring them not only contributes to your diversity and inclusion goals but also qualifies for WOTC, providing a financial incentive for supporting our nation’s heroes.

Unemployment Periods

Veterans experiencing unemployment face significant barriers to re-entering the workforce. Those who have been unemployed for a specific period, especially long-term unemployment, qualify under WOTC. This aims to reduce the unemployment rate among veterans, encouraging employers to give them a chance at a new career.

Active Duty

Transitioning from active duty to civilian employment can be challenging. Veterans looking for work after serving our country can benefit from the WOTC program, which incentivizes employers to hire them. This not only aids in the veteran’s transition but also enriches the workplace with their skills and experiences.

Hiring veterans is more than just a noble act; it’s a smart business decision. The Work Opportunity Tax Credit offers a tangible way to give back to those who’ve served while benefiting from their unparalleled skills and dedication. Employers, take note: when you’re planning your next hire, consider the value and advantages that veterans bring to the table.

As we move into the next section, the WOTC is not just about providing tax benefits; it’s about making a difference in the lives of those who have served our country and are now ready to serve your business. Let’s explore further who qualifies for the work opportunity tax credit and how businesses can tap into this resource.

Long-term and Short-term TANF Recipients

When we talk about who qualifies for the Work Opportunity Tax Credit (WOTC), it’s important to look at individuals who’ve faced significant barriers to employment. Among these groups, Long-term and Short-term TANF Recipients hold a critical spot. Let’s break this down into simpler terms to understand who these individuals are and how they qualify.

Long-term TANF Recipients

Imagine a family that’s been receiving assistance through the Temporary Assistance for Needy Families (TANF) program. If this assistance has been part of their lives for at least 18 consecutive months ending on the hiring date, they fall into the category of long-term TANF recipients.

But life isn’t always straightforward, and neither is assistance. That’s why the rules also cover families who have received TANF benefits for 18 months, which don’t have to be back-to-back, after August 5, 1997. The key here is that the hiring date must be within two years after the end of the earliest 18-month period.

There’s another scenario too. Sometimes, families stop getting TANF payments not because they don’t need them, but because laws cap how long they can receive these benefits. If a family became ineligible for TANF within the past two years due to these legal limits, they’re also considered long-term recipients.

Short-term TANF Recipients

Now, let’s shift focus to those who’ve had a shorter duration of TANF assistance. Short-term TANF recipients are individuals from families that received TANF benefits for any 9-month period during the 18 months leading up to the hiring date. This category captures those who’ve faced significant barriers but for a shorter duration than their long-term counterparts.

Understanding Federal or State Law Limits

Both these categories take into account how federal or state laws impact TANF assistance. For example, if a law says a family can only receive TANF for a maximum of two years, and a family stops getting aid because of this rule, they’re still recognized under the WOTC program. This acknowledgment ensures that the transition from assistance to employment is as smooth as possible, acknowledging the hurdles these individuals have faced.

Why This Matters

Employers looking to understand who qualifies for the Work Opportunity Tax Credit should pay close attention to these groups. Hiring long-term or short-term TANF recipients not only provides businesses with valuable tax credits but also offers a lifeline to individuals striving for self-sufficiency and stability. It’s a win-win situation where businesses can significantly reduce their tax liabilities while contributing positively to the community and the lives of individuals eager to make a fresh start.

The goal of the WOTC is to encourage employment and reduce dependency on government assistance programs. By hiring long-term and short-term TANF recipients, businesses play a crucial role in this transformative journey, turning barriers into bridges towards a better future.

As we delve deeper into the specifics of the WOTC, it becomes clear that this program is not just about financial incentives for businesses. It’s about creating opportunities, fostering inclusivity, and making a tangible difference in the lives of many. Let’s continue to explore other groups that benefit from this impactful program.

SNAP (Food Stamp) Recipients

When we talk about who qualifies for the work opportunity tax credit, it’s important to highlight a group that often faces significant hurdles in finding stable employment: SNAP (Food Stamp) Recipients. This group includes individuals and families who rely on the Supplemental Nutrition Assistance Program (SNAP) to help cover their food expenses. Let’s break down the essentials: age criteria, family benefits, and the transition from economic dependency.

Age Criteria

For SNAP recipients to qualify for the Work Opportunity Tax Credit (WOTC), they need to meet specific age requirements. The individual must be between 18 and 39 years old at the time of hiring. This age range targets a crucial segment of the workforce that can significantly benefit from employment opportunities, thus reducing their need for SNAP benefits.

Family Benefits

SNAP is designed to assist families in stretching their food budget and ensuring they have access to nutritious meals. When a member of a family receiving SNAP benefits secures employment through a WOTC-eligible position, it’s not just an individual achievement. It’s a stepping stone towards financial stability for the entire family. The ripple effect of this can be profound, as it can lead to improved living conditions, better health outcomes, and enhanced opportunities for children in the household.

Economic Dependency

The transition from economic dependency to self-sufficiency is a core goal of the WOTC program. By incentivizing employers to hire SNAP recipients, the program helps individuals move away from needing government assistance to being self-reliant. This transition is crucial not only for the individuals and their families but also for the broader economy. As more people gain steady employment, they contribute to the economy through taxes and reduced reliance on public assistance programs.

Hiring SNAP recipients under the WOTC program is a win-win scenario. Employers get a tax break, which can lower their overall hiring costs. Meanwhile, employees get a chance to work, earn, and contribute to their community in meaningful ways. It’s a strategic move that fosters a more inclusive workforce and supports individuals in overcoming employment barriers.

Remember that the Work Opportunity Tax Credit is more than just a financial incentive. It’s a tool for building a more inclusive society where everyone is given a chance to succeed, regardless of their starting point.

Next, we’ll explore the challenges and opportunities faced by ex-felons and vocational rehabilitation referrals in the job market, and how WOTC plays a role in their journey towards employment.

Ex-felons and Vocational Rehabilitation Referrals

Who qualifies for the Work Opportunity Tax Credit in the context of ex-felons and those undergoing vocational rehabilitation? Let’s break it down into simple terms.

Ex-felons: A Second Chance

First up, ex-felons. For someone who has been convicted of a felony, finding a job can feel like hitting a brick wall. Here’s where WOTC steps in. If an individual is hired within one year of their conviction or release from prison, employers can receive a tax credit. This isn’t just about giving ex-felons a job; it’s about giving them a second chance at building a life post-conviction.

- Key Point: Hired within one year of conviction or release.

- Impact: Helps break down barriers to employment for ex-felons.

Vocational Rehabilitation Referrals: Bridging Gaps

Now, let’s talk about those undergoing vocational rehabilitation. This group includes individuals with physical or mental disabilities that make finding employment challenging. They might be referred to an employer while receiving or after completing rehabilitation services, including state-approved programs, the Ticket to Work program, or services under the Department of Veteran Affairs.

- Key Point: Includes individuals with disabilities referred by approved programs.

- Impact: Encourages the employment of those who might otherwise be overlooked due to their disabilities.

Why It Matters

Both groups face significant hurdles in the job market. The Work Opportunity Tax Credit serves as a bridge, encouraging employers to take a chance on individuals who are ready and willing to work but might need support to get started.

- For Ex-felons: It’s a chance to reintegrate into society and prove their value in the workforce.

- For Vocational Rehabilitation Referrals: It’s an opportunity to show that disability does not define their capability.

Employers who tap into these groups not only gain dedicated employees but also contribute to a more inclusive and diverse workplace. It’s a win-win: businesses can reduce their tax liabilities while playing a crucial role in changing lives.

In summary, who qualifies for the Work Opportunity Tax Credit includes ex-felons and individuals undergoing vocational rehabilitation. By supporting these groups, WOTC not only aids in their journey towards employment but also fosters a more inclusive society.

Next, we’ll delve into the specifics of Designated Community Residents and Summer Youth Employees, further exploring the reach of the Work Opportunity Tax Credit.

Designated Community Residents and Summer Youth Employees

The Work Opportunity Tax Credit (WOTC) reaches out to various groups, aiming to reduce employment barriers. Among those who qualify for the WOTC are Designated Community Residents and Summer Youth Employees. Let’s break down what this means and who exactly falls into these categories.

Rural Renewal Counties and Empowerment Zones

First up, Designated Community Residents. These are individuals who live in either Rural Renewal Counties or Empowerment Zones. But what are these areas? Simply put, they are regions identified by the government as needing economic boost. So, if you live there and are between 18 and 40 years old, you might just be the right fit for WOTC.

Empowerment Zones are urban or rural areas where businesses get tax incentives for investments and hiring. Rural Renewal Counties, on the other hand, are non-metropolitan regions recognized for their declining population. Employers hiring residents from these areas can claim the WOTC, giving them a solid reason to support local employment.

Age-specific Employment

When we talk about Summer Youth Employees, the age factor becomes crucial. This category is specifically for young individuals, aged 16 or 17, looking for summer jobs. However, there’s a catch. Their employment must be within an Empowerment Zone during the summer months, from May 1 to September 15. This focus on youth aims to encourage early work experiences in environments that need economic revitalization.

Seasonal Employment

Seasonal employment, especially for Summer Youth Employees, is a unique aspect of the WOTC. It’s designed to benefit young people living in Empowerment Zones by providing them with employment opportunities during the summer break. This not only helps them earn some money but also instills work ethics and valuable job skills at a young age.

Employers benefit too. By hiring young residents from these areas for the summer, businesses can claim a tax credit. It’s a win-win. The community gets a boost through local employment, and businesses enjoy tax benefits, making the hiring of young individuals an attractive proposition.

In summary, Designated Community Residents and Summer Youth Employees are crucial components of the Work Opportunity Tax Credit. By focusing on Rural Renewal Counties, Empowerment Zones, and age-specific as well as seasonal employment, WOTC encourages businesses to invest in local talent. This not only helps in reducing employment barriers but also supports economic growth in areas that need it the most.

Next, we will answer some Frequently Asked Questions about WOTC, clearing up common confusions and providing you with the information you need to know.

Frequently Asked Questions about WOTC

Who benefits from WOTC?

Employers get a financial boost by hiring individuals who might otherwise find it difficult to get jobs. This includes a wide range of businesses, from small local shops to large corporations, all of whom can reduce their tax liability by taking advantage of WOTC.

Employees from targeted groups get a better shot at employment. While they don’t directly receive the tax credit, being part of a WOTC-targeted group can make them more attractive to potential employers, opening up more job opportunities.

Tax-exempt organizations, particularly those hiring qualified veterans, can also benefit. They claim the WOTC against their payroll taxes, helping them save money and invest more into their missions.

What is the maximum work opportunity tax credit?

The maximum credit an employer can claim varies. For most eligible groups, it’s up to $2,400 per hire. However, for veterans, depending on specific factors like duration of unemployment and service-connected disabilities, this amount can go up to $9,600 per hire.

How do employers claim the WOTC?

Certification process: Before claiming the credit, employers must ensure their new hire is certified as belonging to one of the WOTC’s targeted groups. This involves a two-step process:

-

IRS Form 8850: This is the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, filled out by both the employer and the job applicant. It must be completed and submitted to the State Workforce Agency (SWA) within 28 days of the employee’s start date.

-

ETA Forms 9061 and 9062: Depending on whether the employee’s eligibility is already known or needs to be determined, one of these forms will also need to be submitted to the SWA.

Qualified wages are the basis for the credit calculation, focusing on the first year of employment. The credit is calculated as a percentage of these wages, encouraging longer employment periods and rewarding employers for providing substantial hours of work to these individuals.

By following these steps and understanding the benefits, employers can effectively navigate the WOTC process, contributing positively to their communities while enjoying financial incentives. This section aims to demystify the process and encourage more businesses to participate in this mutually beneficial program.

Conclusion

As we’ve journeyed through the intricacies of the Work Opportunity Tax Credit (WOTC), it’s clear that this program is not just a pathway to financial savings for businesses but also a beacon of hope for individuals facing employment barriers. At Rockerbox, our mission is to bridge the gap between these opportunities and the businesses that can benefit from them.

Simplifying the Tax Credit Process

Navigating the WOTC can seem daunting with its certification processes and eligibility criteria. That’s where we come in. Rockerbox is dedicated to simplifying this process, making it more accessible and less time-consuming for businesses of all sizes. Our technology-driven solutions streamline the screening and application process, ensuring that no eligible candidate slips through the cracks.

Our platform is designed to be user-friendly, allowing you to quickly identify who qualifies for the work opportunity tax credit among your candidates. This not only saves time but also maximizes your chances of receiving the credit.

Maximizing Cash Flow

The financial benefits of the WOTC are undeniable. By reducing federal tax liability, businesses can significantly improve their cash flow. This extra liquidity can be the key to growth, enabling investment in new projects, expansion into new markets, or simply providing the financial stability needed in today’s competitive landscape.

But the benefits extend beyond the immediate financial gains. By participating in the WOTC program, businesses contribute to a more inclusive and diverse workforce. This not only enriches the company culture but can also lead to innovative ideas and perspectives, driving further success.

At Rockerbox, we’re committed to ensuring that businesses don’t miss out on these opportunities. Our expertise and technology are at your disposal, helping you navigate the complexities of tax credits and incentives with ease. Whether you’re new to the WOTC or looking to optimize your existing tax credit strategies, we’re here to help.

Discover how Rockerbox can transform the way you approach the Work Opportunity Tax Credit and turn a complicated process into a strategic advantage for your business. Learn more about our services and how we can help.

Together, let’s unlock the full potential of tax credits and pave the way for a more prosperous and inclusive future.